Retail disputes self serve

Helping people get their money back when retailers have refused a refund. This process is often called a 'retail dispute' and helps protect consumer's rights.

"Simple process, very reassuring. Feels like the banks on the customer's side for once" NatWest Customer

The project objectives

I kicked off with a collaborative scoping workshop, along with stakeholder interviews to explore business and customer needs. This allowed me to define the following four objectives.

01

Redesign and launch existing web journeys for desktop, tablet and mobile experiences.

02

Reduce number of user errors and increase journey completion rate (35% dispute claims rejected).

03

Reduce the number of customers phoning call centre for clarification and status updates.

04

Delivery MVP journey and assets with supporting strategic road map.

Discover

For efficiency I chose to use a hybrid research method combining generative discussion about past experiences (discovery) with testing of an early proof of concept journey (validation).

Understanding the as-is customer experience

Defining and prioritising research hypothesis

I worked with the Researcher to analyse and prioritise customer jobs, pains and gains following the scoping workshop. These were grouped into themes then reframed as research questions.

Identifying the highest volume journeys

In total there are 26 different dispute types, split into 6 categories. Reviewing MI data showed that 56% of all dispute cases related to one dispute type. So it made sense to start here.

Journey mapping and analysis

After analysing the legacy journey, I mapped out all key interactions, user flows and steps throughout the process to create the new journey.

.png)

Define

Creating actionable insights

Following discovery I worked with the Researcher to analyse customer research data and create the following actionable insights. These would be used to revisit MVP scope with stakeholders.

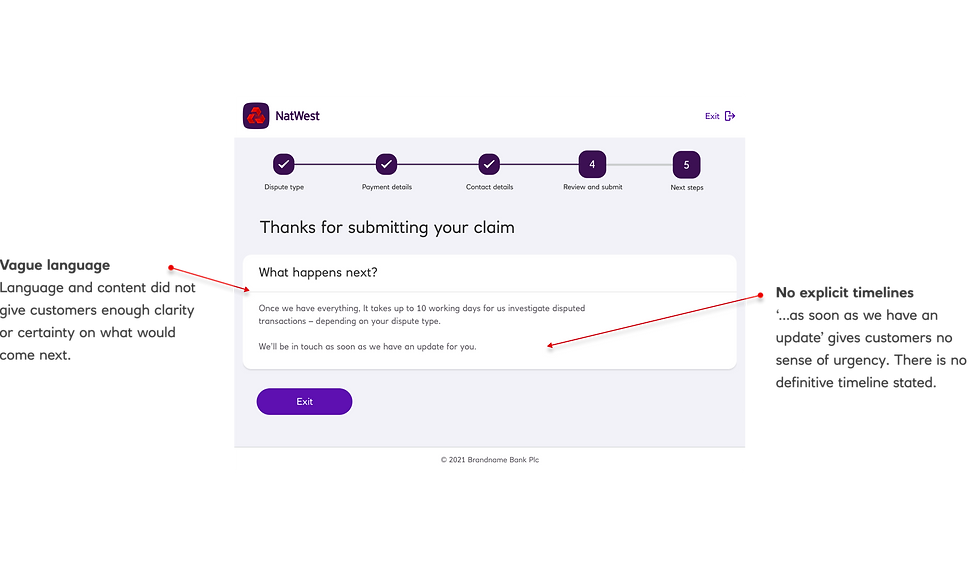

Overall, the new journey tested well, but there was room for improvement

100% of customers could successfully submit a claim without any additional help.

User flow was logical

So what...

The new 5 step journey was logical and easy to navigate.

Routes from online banking into the journey does not align to their mental model.

Entry points weren't clear

So what...

Discoverability needed to be reviewed and improved.

The landing page did not effectively triage customers into the correct journey.

Landing page was unclear

So what...

Signposting and content would have to be refined.

Showing a journey map at the start manages expectations & supports navigation.

Early visibility is key

So what...

This would become a key navigation principle.

I started with ideation and concept sketching

I find this is an effective way of making high-level concept decisions early in the process. When mentoring junior designers I encourage them to experiment with sketching rather than jumping to digital first.

Lean customer research

I defined the initial research approach, then collaborated with Research to refine a plan. I started by analysing the legacy journey then creating the required stimulus to drive discussion with customers.

Identifying customer needs

I worked with the Product Owner and Researcher to identify customer needs. These were prioritised and used to shape research hypothesis.

Journey mapping

After analysing MI data and the legacy journey, I mapped out key interactions and steps to create a new five journey.

Creating complex user flows and features around customer scenarios

The simple proof of concept journey tested during the discovery phase didn’t include any complex tasks like adding more payments to the claim or filling out complex details about the dispute itself.

Allowing customer to easily add more payments to their claim

To enable customers to add more payments to their claim, I created a ‘basket’ concept. I referenced e-commerce checkout experiences to improve usability.

Building in positive friction to reduce errors

To ensure certain actions such as removing payments, couldn't be carried out in error, I introduced positive friction and feedback at key points.

Deliver

Building and launching the product

The deliver phase started with usability testing of complex flows and new features. Once I had enough confidence in the designs effectiveness, I created a three phase delivery roadmap to begin build.

Usability testing highlighted ways to improve the experience

Customer feedback was resoundingly positive, with all user flows proving easy to understand and navigate. Only minor copy and layout changes were required.

Develop

From insight to experience

During discovery we uncovered common customer scenarios and edge cases. I used these to align the team and establish an operating rhythm which focussed on real customer needs for each sprint.

The impact

The outcome exceeded all expectations

Not only did our work achieve all business objectives and meet customer needs, as shown below. But my scenario based design approach was replicated across further business areas and journeys.

Analytics reports and NPS surveys showed these results and customer feedback

99%

of all cases are processed successfully first time for customers. The legacy journey stood at only 65%.

1M+

Disputes Self Serve claims successfully processed within one year of the MVP launch.

"Simple process, very reassuring. Feels like the banks on the customer's side for once"

“The online process was easy to understand and complete. The team emailed me promptly about the dispute”

The journey was benchmarked as 'best in class'

Stakeholders were so pleased with the outcome they went back to to the same benchmarking agency my team engaged during discovery to complete a second independent analysis.

"NatWest stands out as best-in-class with the level of guidance offered to users around the disputes process – there is a clear structure around timelines and actions pre- and post-submission“

If you've come this far, hopefully you want to see more of my work

Creating a complex internal tool for customer service agents

Evolving the way children learn about money and build independence

Mobile screens

A selection of core screens

Case study summary

Problem

The legacy self serve dispute process had 35% completion rate and high number of errors, prompting customers to phone call centres for support.

Approach

I pioneered a method called 'Strategic Vision Meets Tactical Delivery,' allowing me to meet tight build timelines while refining the user experience.

Outcome

The MVP increased completion rates from 65% to 99%, with over one million visits in the first year. It was reviewed as 'best in class' amongst UK banks.

As Lead UX Designer, I was responsible for defining the product design approach, establishing priorities, ensuring business goals are achieved.

My role

-

Lead UX Designer (Me)

-

UX researcher

-

Copywriter

-

Visual Designer

Core Design team

-

Product Owner

-

Business Analysts

-

Scrum Master

-

Development team

Wider team

Fin.

Using data to identify MVP journeys

In total there are 26 different dispute types. Reviewing MI data showed that 56% of all dispute cases related to one dispute type. So it made sense to start here.

Disputes related to cancelled subscriptions or free trials

Ensuring all designs are fully accessible

I brought in accessibility specialists to collaborate on error patterns and ensure all design met required WCAG standards. This input helped up-skill the team.

Retail Disputes Self Serve

The mobile experience

Testing proof of concept to validate assumptions early

I translated the new journey into medium fidelity wireframes and created a clickable prototype. This was used a stimulus during customer research / testing.

Strategic vision meeting tactical delivery

To launch the product, I collaborated with Product, Engineering and delivery teams on a 3 phased UX roadmap. This was prioritised around business and customer value to have the biggest impact

01: MVP journey - Free trials and subscriptions

56% of all dispute cases were for subscriptions and free trials. Launching this first would deliver the highest value in the shortest time.

UX complexity:

% of all components:

02: Additional transactions features

Features for adding / removing transactions were launched second. Meaning dispute types with multiple transactions could now be processed.

UX complexity:

% of all components:

03: Flights & holidays

'Flights and holidays' required very complex UX but made up for a small amount of claims annually. The smaller ROI meant these would be launched last.

UX complexity:

% of all components:

Using data to identify MVP scope

In total there are 26 different dispute types. Reviewing MI data showed that 56% of all dispute cases related to one dispute type. So I prioritised this journey for MVP.