The project objectives

The ask was to create a strategic proposition which would be capable of delivering the following outcomes and secure funding for a proof of concept build.

01

Educating Customers to help them engage with long-term planning

02

Link the concept of financial investments to existing savings behaviours and habits

03

Nudge people towards initiating their first time investment

Discover

I started the research with a market scan and desk research into behaviours. I then interviewed 10 customer and surveyed 100 to deep dive into relevant areas.

I used qualitative and quantitative research

Moderated interviews explored key moments

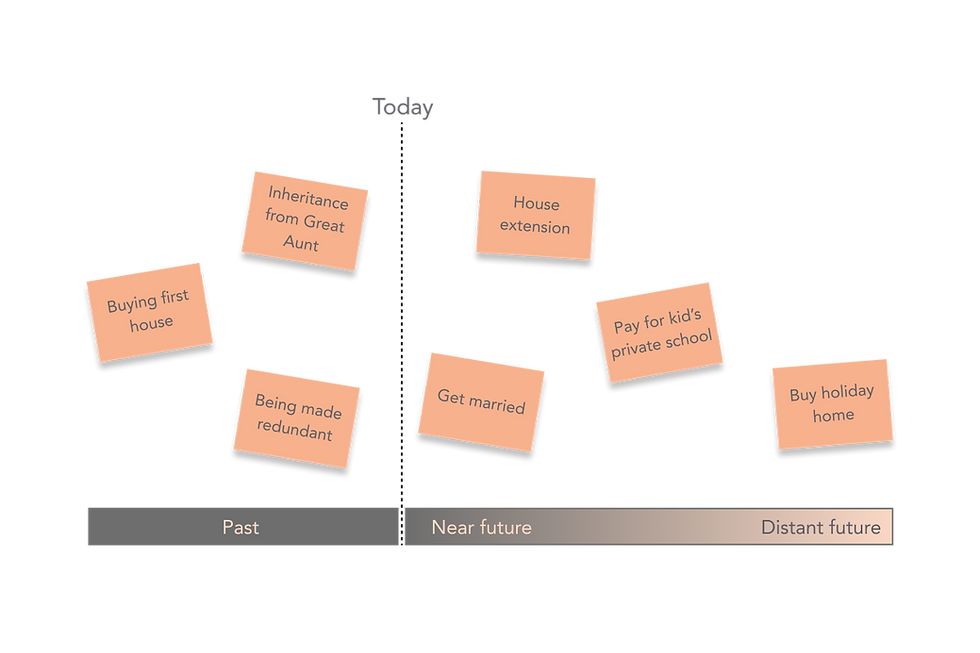

During interviews I asked customers to create a timeline of significant events which influence their views and behaviours around money.

Define

Collaboratively shaping robust insights

We were able to uncover new insights which helped understand the barriers holding people back from making their first investment.

We uncovered the following issues held people back from investing

01

Attitudes and beliefs

Preconceived notions of investing or what it means to become an investor are heavily influences by family background and demographic. This extends to lack of knowledge and understanding.

02

Competing priorities of life

Investing is not a priority for most people. There are other personal financial goals that take precedence. For example; Marriage, House, Car, Kids, Holidays etc. Customer are only willing to entertain investment it these are considered.

03

Tangibility matters

Customers can focus and take steps towards tangible goals (houses, cars, holidays) but often struggle to relate to intangible ones (pensions/investment). This is why they choose to invest in property over funds, stocks and shares.

04

Social influencers

People feel more comfortable trusting personal social influencers (family / friends) when it comes to financial advice. This personal connection is often given a higher value than genuine expertise and knowledge.

Develop

Co-designing a new proposition ideas

Co-design facilitation has always been one of my strongest points. I led a collaborative ideation workshop where groups ideated around each of the insights.

*At this point in the project we made a decision to focus on Yvette rather than Robin.

Deliver

Testing and refining design hypothesis

I held 6 follow up interview to test the customer journey and refine hypothesis. After some small tweaks and reordering of steps, we created the following journey.

* Visual design from Martin Sweeney

Creating hypothetical personas

These were used to create recruitment profiles and align on research themes / assumptions to validate during discovery.

Yvette, 32

-

Yvette is a regular saver

-

Security and comfort is worth more than taking risks

-

She appreciates tangibility - being able to see, touch and feel the impact of her money

-

She plans her finances to achieve tangible goals

.jpg)

Robin, 36

-

Robin could be a saver but he spends his money freely, enjoying his day-to-day life

-

He prioritised the here and now

-

He doesn't monitor his expenditure regularly

-

He doesn't save for the future.

1.The hook

Hypothesis

If Yvette receives a recommendation of a product or service from a well-informed close friend she is more likely to trust the message/content/brand and chose to explore further. Content shared by a friend is disarming.

Insight inspiration

Social Influencers

Behavioural theory

Social proofing

5. Investor stories

Hypothesis

Once Yvette's investment future feels attainable, she will explore other people's experience in more detail and would choose to relate these benefits to their own circumstances and motivations.

Insight inspiration

Attitudes & Beliefs

Competing life priorities

Behavioural theory

Social proofing

Emotional engagement

2. The personality quiz

Hypothesis

Think Myers Briggs meets My Creative Type. By curating a playful and human conversation, through asking relatable questions about personal preferences, we can give an engaging introduction which feels far removed from the traditional formality of finance.

Insight inspiration

Attitudes & Beliefs

Behavioural theory

Gamification

3. Your investment type

Hypothesis

Presenting Yvette with a profile which feels accurate will have a disarming effect. If she perceives her results to be true, she is more likely to accept recommendations and entertain the idea that she could be an investor too. Creating a clear link between her personality characteristics and investment fund will make investment relatable and human.

Insight inspiration

Attitudes & Beliefs

Competing life priorities

Behavioural theory

Personalisation

Social proofing

4. Call to action

Hypothesis

If we lead with the benefit and highlight the potential financial gains from Investment earlier (once people have warmed to the concept), we can grab attention. With her investment future feeling tangible and realistic, she wants more and is open to further reading /education / conversation.

Insight inspiration

Tangibility matters

Behavioural theory

Loss aversion bias

The impact

Our work secured £400K to build a proof of concept

The 'Funds Like Me' proposition and business case was used to plan and deliver a road map of activity which would enhance NatWest's Investment offering.

Weaving concepts into a cohesive customer journey

To create a new proposition, it was necessary to arrange and link the concepts into a cohesive logical journey. We explored different sequences and landed on the following five steps.

Fin.

If you've come this far, hopefully you want to see more of my work

Designing a high volume consumer experience for web and mobile platforms

Evolving the way children learn about money and build independence

Funds Like Me

Creating a new innovation proposition using behavioural science to nudge people towards making their first financial investment.

.jpg)

"There’s less of that corporate element, it’s more human and less robotic, more relatable”

Case study summary

Problem

NatWest data showed a significant amount of customer with £50K+ sitting in savings accounts. Investing this money rather than saving could have dramatic impact on their future financial picture, yet they chose not to do so.

Approach

I defined an approach following the Double Diamond methodology. Co-creation workshops played a major role in shaping the features. I then used behavioural science principles to refine the proposition.

Outcome

A strategic investment proposition using behavioural science to challenge beliefs and nudge people towards their first investment. The supporting business case received £400K to build a POC.

As Lead Innovation Designer, I was responsible for defining a design approach, shaping the proposition visions and leading the team to create and refine the strategic road map.

My role

-

Lead Innovation Designer (Me)

-

Innovation Designer

-

Visual Designer

-

Deliver Manager

-

Business Analyst

Core Design team

-

Product Owner

-

Investment Managers

-

Strategy Consultants

-

Wide range of SMEs

Wider team

Funds Like Me

Making financial investment feel more human

Bringing data points together

Using collaborative synthesis workshops, we brought together data from qualitative interviews, quantitative studies and desk research.

Affinity mapping

Individual observations and quotes from interviews were discussed

Defining themes

Groups were formed and reformed with relevant headings describing the connections

Qualitative x quantitative

We overlayed qualitative findings and market analysis to triangulate insights.

Refining workshop outcomes using behavioural psychology models

We reviewed concepts developed during the ideation workshop through a behavioural psychology lens. This helped understand how to make them even more effective.

Funds Like Me

Discover funds which match your personality. Demystifying investments, making portfolios more tangible and relatable.

Life Planner

An interactive forecasting tool which uses 'people like you' success stories to prompt customers into sharing goals.

My Investment Type

A playful profiling tool that generates interest in customers understanding, knowledge and mindsets around investment.